Did you hire a credit repair or debt consolidation companies, or debt settlement company that made unkept promises or charged you before performing services? Did you receive a mail about a class action on the settlement to resolve claims about repair or consolidate debt companies that took advantage of customers? This review will help you partake in the class action settlement after confirming the authenticity of the mail.

What Is Debt Consolidation Company Class Action Settlement?

Debt consolidation companies promise to reduce your debt by allowing you to make one monthly payment while only paying a portion of your debt, while debt settlement companies offer to settle your debts for “pennies on the dollar.” Credit repair companies help consumers dispute inaccuracies on their credit reports. However, some of these organizations may overstate their services in the hopes of getting business. These companies claim to allow you to make monthly payments while creditors continue lawsuits and other collection activities. All these practices are regulated by the Credit Repair Organizations Act. However, even though some of these actions are illegal, some credit repair companies, debt consolidation companies and debt settlement companies may still operate in these ways and may be take advantage of customers.

What Is This Class Action All About?

The Credit Repair Organizations Act is a law that protects consumers from exploitation by credit repair organizations. When they operate legally, credit repair organizations can help consumers dispute inaccuracies on their credit reports. However, they cannot perform any services that a consumer cannot perform themselves. Consumers are legally allowed and capable of communicating directly with the three credit reporting agencies — Experian, Equifax and TransUnion — to dispute inaccuracies on their credit reports. However, some individuals may find this process to be confusing, overwhelming or time-consuming. In these instances, they may find it easier to hire a credit repair organization to dispute credit inaccuracies for them.

When a credit repair organization is hired, they are required under the Credit Repair Organizations Act to inform consumers that the organization cannot perform services that the consumer cannot complete themselves. This is to ensure that the credit repair organization cannot mislead consumers into thinking that hiring a credit repair organization can perform impossible tasks related to credit reporting.

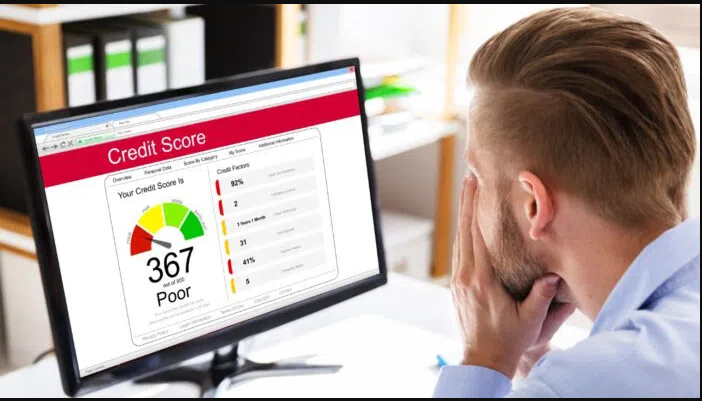

For example, credit repair organizations cannot advertise they can change correct information on a credit report. In some instances, consumers with low credit may wish that they could change accurate information on their credit reports if they have a low credit score. However, this is not possible.

The Credit Repair Organizations Act further protects consumers by prohibiting credit repair organizations from charging consumers before they perform services. Legally, a credit repair organization can bill monthly after services have been rendered or can bill per item corrected on a credit report.

To ensure that billing is done legally, the Credit Repair Organizations Act requires credit repair organizations to create written contracts with their clients. If you contracted with a credit repair organization but did not receive a written contract, even if they billed you at the correct time, you may have a legal claim.

Reaching out to a qualified attorney can be the first step to effectively protecting your finances and credit if you have been harmed by an unethical credit repair organization. You may be able to file a Credit Repair Organizations Act lawsuit and may be able to receive compensation for your injuries.

Who Is Eligible?

The settlement benefits all class members who hired a credit repair organization that made unkept promises or charged you before performing services.

How To Be Part of This Settlement

For a class member to partake in this settlement, they must submit their Valid claim on the settlement website.

What Is The Pay For This Settlement?

The pay for this settlement varies and the proof of purchase is not necessary.

Conclusion

As you submit your claim to the settlement website, just like EBT illegally exposed numbers class action settlement we have reviewed , you’re doing so under penalty of perjury. You are also harming other eligible Class Members by submitting a fraudulent claim.